05 March 2025

- RSIS

- Publication

- RSIS Publications

- IP25023 | Beyond Numbers: Submarine Proliferation in Asian Waters

SYNOPSIS

A bean-count of submarine fleets across Asia indicates proliferation is under way but numbers only tell part of the story. Whereas submarine fleet sizes remain more or less static in most Asian navies, there is real qualitative evolution taking place as new boats enter service. These attributes could become root causes for interstate misperceptions and potentially intensify the underwater arms competition. At the same time, the lacklustre progress on measures to mitigate submarine-related accidents at sea and lack of focus on preventive measures are sources of concern.

COMMENTARY

Undersea cable rupture incidents in the Baltic Sea and around Taiwan Strait have seized headlines in recent years, prompting huge interest among scholars and policymakers in the security of critical undersea infrastructure. To be sure, the vast economic and strategic importance of these cables cannot be underestimated. However, a less headline-grabbing development is the persistent trend of submarine proliferation in Indo-Pacific waters.

The Numbers

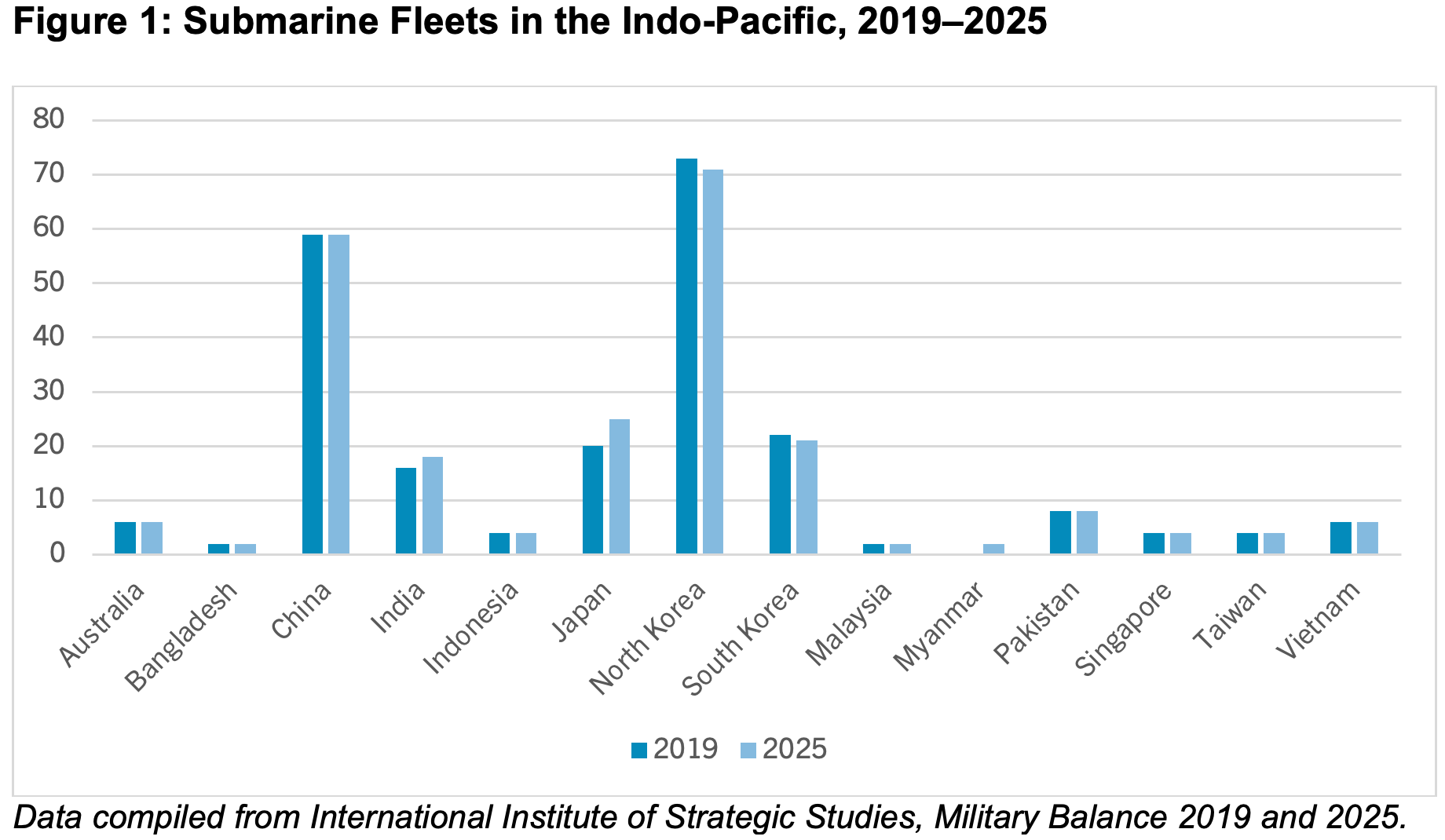

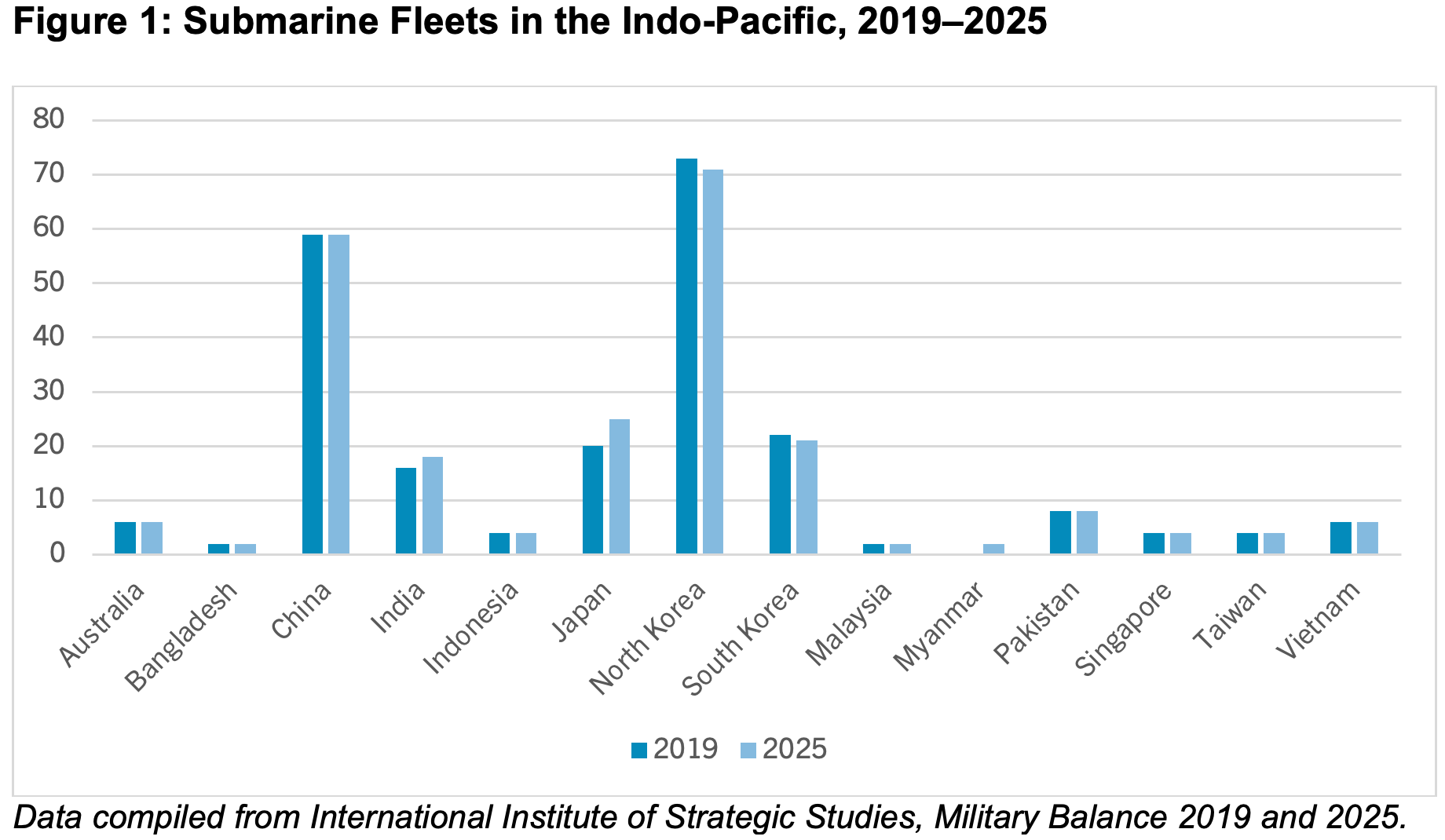

Between 2019 and 2025, submarine fleets in the Asia-Pacific have remained more or less steady in terms of numbers, except for India and Japan, which saw their submarine forces expanding from 16 to 18, and 20 to 25 respectively, and Myanmar acquiring a submarine each from China and India during COVID-19 (Figure 1). Post-pandemic, as Asian economies began recovering and in the face of an increasingly fraught regional security landscape, the renewed interest in military modernisation has invariably included this undersea realm.

Notably, continued interest in beefing up undersea warfare capabilities in Southeast Asia means navies are looking to new acquisitions. Indonesia aims to possess a total of 10 submarines by 2029. To that end, it has contracted France for lithium battery–equipped Scorpene Evolved–class boats. Singapore has completely phased out the vintage Challenger-class boats, which formed the seeds of its undersea force, following the commissioning of its first pair of Invincible-class submarines built in Germany. A second pair is due by 2028, whereas the announcement by Singapore’s defence minister Ng Eng Hen during this week’s parliamentary session that the navy is to acquire a third pair would eventually yield a six-strong future fleet as the Archer-class boats phase out.

Malaysia, which has been operating two submarines for about two decades, plans for a second pair but funding constraints mean this expansion is put on hold while advancing priority programmes such as the Littoral Combat Ship and Littoral Mission Ship Batch-II. Thailand’s programme to acquire three S26T boats from China appears to be in limbo following contractual issues over the propulsion system. Like Bangkok, Manila is also a submarine aspirant in Southeast Asia, with plans for at least two boats, but funding challenges would put acquisitions in the near term on hold for now.

To the west, India and Pakistan are the key submarine-operating South Asian navies with new acquisition plans. The Indian navy envisages at least 18 conventional submarines, four nuclear-powered ballistic missile submarines and six nuclear-powered attack submarines. By this year, the goal of at least 18 conventional boats has been attained, though it represents a mix of new and vintage assets. The Pakistani navy reported in early 2023 steady progress with its Hangor-class submarine project.

Further north, China is pushing on with its nuclear submarine programmes. Satellite imagery of the submarine yard in Bohai published in early 2021 indicates new nuclear boats under construction. At the same time, Beijing is advancing its conventional submarine programme — its official navy WeChat account revealed an image in July 2022 of a latest type-039 variant sporting a new sail that may herald new stealth capabilities. Taiwan’s navy is advancing its Indigenous Defence Submarine programme, with the lead boat, Hai Kun, slated for sea acceptance trials this April. Taipei expects to operate eight boats eventually, barring funding and technical hurdles.

Japan has been steadily expanding its fleet, commissioning more Taigei-class submarines, having launched the fifth boat last October and commissioning the fourth one this week. As South Korea’s first ballistic missile–capable KSS-III submarine Dosan Ahn Changho, commissioned in 2021, embarked on its maiden patrol in 2022, the country is embarking on the follow-on KSS-III Batch-II programme, having cut steel for the third and final boat last October. Arch-rival North Korea has made a recent significant addition to its vintage submarine fleet with a “tactical nuclear attack submarine”, with hull number 841 and bearing the name Hero Kim Kun-Ok. Preliminary imagery assessment shows the primary payload of this submarine, believed to be a reworked Soviet-vintage Romeo-class, to be capable of accommodating ballistic and cruise missiles.

Quality Matters

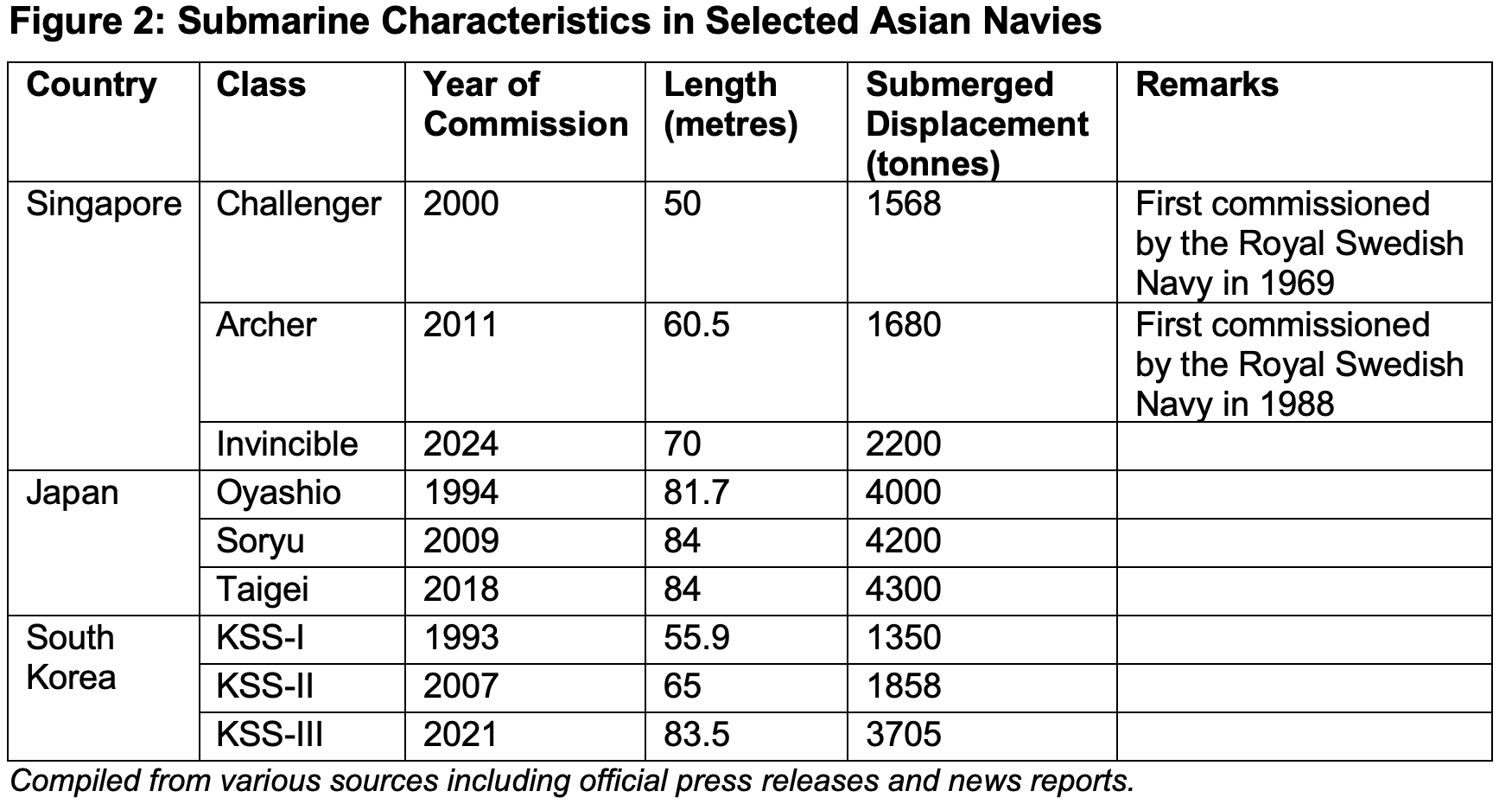

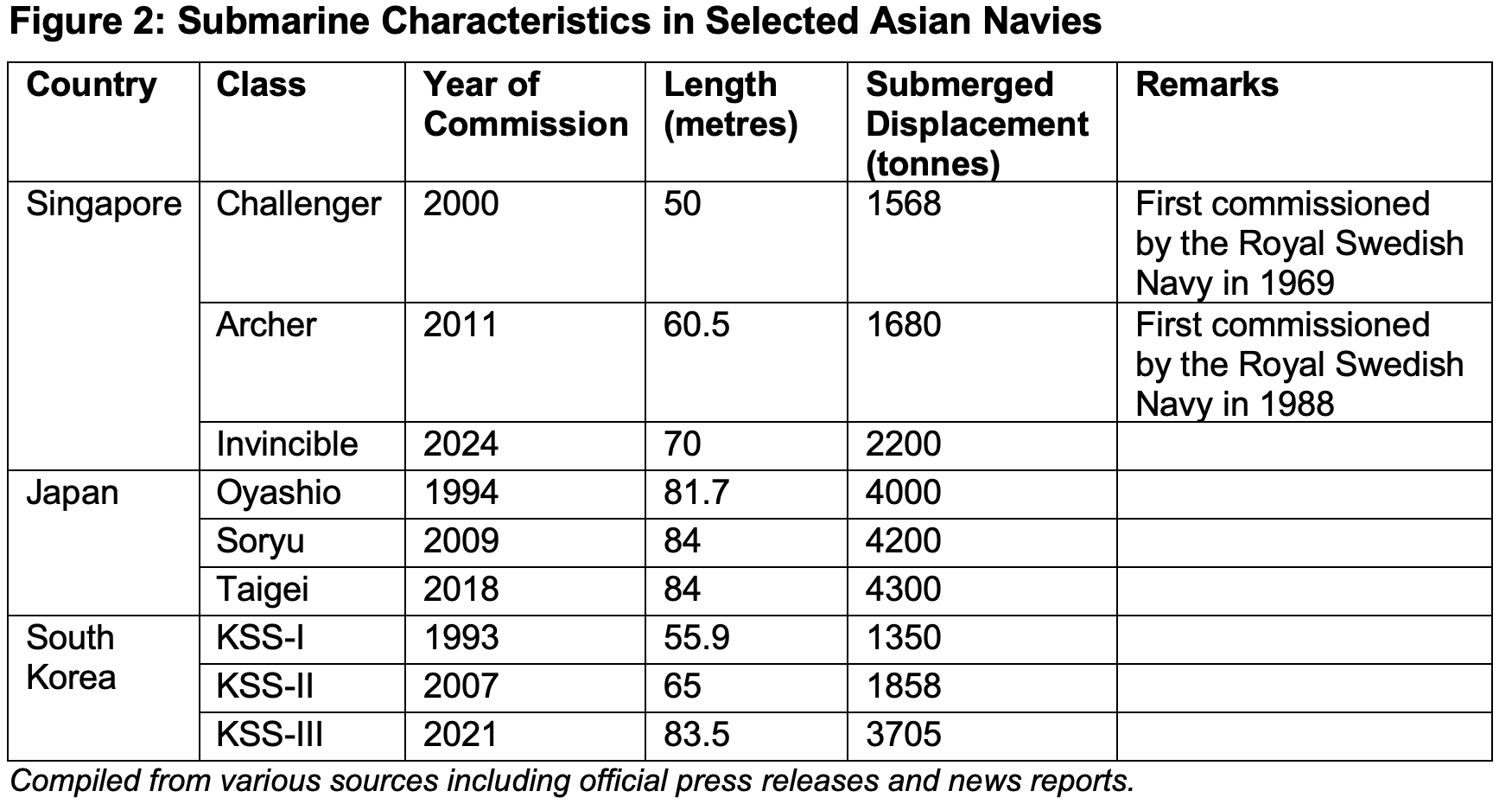

It is clear that submarine fleet expansion programmes across Asia are proceeding in earnest. But obsession with numbers, much like the obsession with defence spending figures, often distracts one from a deeper inquiry into the qualitative characteristics of this phenomenon. While the submarine count in some of the regional navies may remain static, that does not necessarily detract from the qualitative evolution of their submarine fleets. Generally, besides fleet sizes, the technical capabilities of submarines entering service with Indo-Pacific navies have improved. Submarines in most fleets have become progressively bigger over the decades in terms of length and displacement (see Figure 2 for a sample of navies)

Size confers numerous straightforward operational and tactical advantages. Most intuitive of all, a larger submarine typically has a larger payload for combat systems, weapons, and other mission equipment. The other important benefit is more space for enhanced crew habitability — a key concern in recent times as regional navies struggle to recruit submariners, given that a submarine usually has cramped spaces on board and offers nothing more than a spartan lifestyle.

Combined with better payloads and crew habitability, new submarines entering service with Asian navies also increasingly sport new propulsion systems. For conventional fleets, Stirling or fuel cell–type air-independent propulsion (AIP) — dubbed the “poor man’s nuclear submarine propulsion” — confers conventional submarines greater underwater endurance with reduced need for snorkelling (meaning, expelling exhausts while taking in air, usually to recharge batteries). Some submarines, such as the Japanese Soryu/Taigei and Indonesia’s planned Scorpene Evolved sport lithium batteries which, unlike typical AIP, confers the additional feature of higher underwater burst speeds. At least six Asian submarine-operating navies are already operating, or in the midst of acquiring, these new propulsion technologies.

A submarine’s real combat power lies not just in its size, but also the type of payloads on board. Traditionally, submarines carry torpedoes and mines. Unlike boats built before 1945, modern equivalents no longer carry deck guns. But today’s submarines are increasingly capable of a more diverse payload. For example, underwater-to-surface guided weapons, such as anti-ship and land attack cruise missiles, offer long-range, standoff striking power. The redundancies conferred by larger payloads on board the modern submarine also allow future incorporation of new technologies, such as unmanned systems. Topping off the larger and more diverse payloads, contemporary submarines entering service with Asian navies are also increasingly “quieter”, with not only better acoustic emission characteristics for the propulsion but also hydrodynamic designs and use of anechoic tiles installed on the hull to absorb detection sonar waves.

Parting Thoughts

The Asian undersea realm has been a long-standing area of interest for many regional navies as an outcome of threat perception and the bid to create “balanced fleets” that serve as insurance against extant geopolitical uncertainties. While the expanding numbers of submarines entering service matter, it is important not to overlook the evolving qualitative characteristics of new boats coming online at present and into the future. These attributes could potentially give rise to misperceptions about strategic intent and pose possible risks, especially in the contentious Asian littorals revolving around geopolitical flashpoints such as the South China Sea. While the current submarine proliferation can be more suitably characterised as “underwater arms competition” and not a relentless “underwater arms race” for now, recent geopolitical upheavals in the region still provide grounds for concern.

Somewhat more worrisome has been the potential risk of accidents at sea. Recent collisions involving the American submarine Connecticut in the South China Sea in late 2021 and Japanese submarine Oyashio in early 2022 suggest that such risks can no longer be taken for granted. Most navies in the region have mainly focused on mitigatory measures, for example acquiring new submarine emergency response capabilities. But such programmes are accorded much less priority than plans to acquire submarines and other big-ticket combat assets. Some navies have struck bilateral submarine rescue pacts either as a stop-gap before acquisition of, or to complement, national capabilities. While regional geopolitics have become more contentious, resulting in a deep strategic trust deficit among governments, it is necessary to seriously consider preventive measures, such as prevention of mutual interference and water-space management initiatives.

Collin Koh is Senior Fellow at the Institute of Defence and Strategic Studies, S. Rajaratnam School of International Studies (RSIS). He primarily researches maritime security and naval affairs in the Indo-Pacific region, focusing on Southeast Asia.

SYNOPSIS

A bean-count of submarine fleets across Asia indicates proliferation is under way but numbers only tell part of the story. Whereas submarine fleet sizes remain more or less static in most Asian navies, there is real qualitative evolution taking place as new boats enter service. These attributes could become root causes for interstate misperceptions and potentially intensify the underwater arms competition. At the same time, the lacklustre progress on measures to mitigate submarine-related accidents at sea and lack of focus on preventive measures are sources of concern.

COMMENTARY

Undersea cable rupture incidents in the Baltic Sea and around Taiwan Strait have seized headlines in recent years, prompting huge interest among scholars and policymakers in the security of critical undersea infrastructure. To be sure, the vast economic and strategic importance of these cables cannot be underestimated. However, a less headline-grabbing development is the persistent trend of submarine proliferation in Indo-Pacific waters.

The Numbers

Between 2019 and 2025, submarine fleets in the Asia-Pacific have remained more or less steady in terms of numbers, except for India and Japan, which saw their submarine forces expanding from 16 to 18, and 20 to 25 respectively, and Myanmar acquiring a submarine each from China and India during COVID-19 (Figure 1). Post-pandemic, as Asian economies began recovering and in the face of an increasingly fraught regional security landscape, the renewed interest in military modernisation has invariably included this undersea realm.

Notably, continued interest in beefing up undersea warfare capabilities in Southeast Asia means navies are looking to new acquisitions. Indonesia aims to possess a total of 10 submarines by 2029. To that end, it has contracted France for lithium battery–equipped Scorpene Evolved–class boats. Singapore has completely phased out the vintage Challenger-class boats, which formed the seeds of its undersea force, following the commissioning of its first pair of Invincible-class submarines built in Germany. A second pair is due by 2028, whereas the announcement by Singapore’s defence minister Ng Eng Hen during this week’s parliamentary session that the navy is to acquire a third pair would eventually yield a six-strong future fleet as the Archer-class boats phase out.

Malaysia, which has been operating two submarines for about two decades, plans for a second pair but funding constraints mean this expansion is put on hold while advancing priority programmes such as the Littoral Combat Ship and Littoral Mission Ship Batch-II. Thailand’s programme to acquire three S26T boats from China appears to be in limbo following contractual issues over the propulsion system. Like Bangkok, Manila is also a submarine aspirant in Southeast Asia, with plans for at least two boats, but funding challenges would put acquisitions in the near term on hold for now.

To the west, India and Pakistan are the key submarine-operating South Asian navies with new acquisition plans. The Indian navy envisages at least 18 conventional submarines, four nuclear-powered ballistic missile submarines and six nuclear-powered attack submarines. By this year, the goal of at least 18 conventional boats has been attained, though it represents a mix of new and vintage assets. The Pakistani navy reported in early 2023 steady progress with its Hangor-class submarine project.

Further north, China is pushing on with its nuclear submarine programmes. Satellite imagery of the submarine yard in Bohai published in early 2021 indicates new nuclear boats under construction. At the same time, Beijing is advancing its conventional submarine programme — its official navy WeChat account revealed an image in July 2022 of a latest type-039 variant sporting a new sail that may herald new stealth capabilities. Taiwan’s navy is advancing its Indigenous Defence Submarine programme, with the lead boat, Hai Kun, slated for sea acceptance trials this April. Taipei expects to operate eight boats eventually, barring funding and technical hurdles.

Japan has been steadily expanding its fleet, commissioning more Taigei-class submarines, having launched the fifth boat last October and commissioning the fourth one this week. As South Korea’s first ballistic missile–capable KSS-III submarine Dosan Ahn Changho, commissioned in 2021, embarked on its maiden patrol in 2022, the country is embarking on the follow-on KSS-III Batch-II programme, having cut steel for the third and final boat last October. Arch-rival North Korea has made a recent significant addition to its vintage submarine fleet with a “tactical nuclear attack submarine”, with hull number 841 and bearing the name Hero Kim Kun-Ok. Preliminary imagery assessment shows the primary payload of this submarine, believed to be a reworked Soviet-vintage Romeo-class, to be capable of accommodating ballistic and cruise missiles.

Quality Matters

It is clear that submarine fleet expansion programmes across Asia are proceeding in earnest. But obsession with numbers, much like the obsession with defence spending figures, often distracts one from a deeper inquiry into the qualitative characteristics of this phenomenon. While the submarine count in some of the regional navies may remain static, that does not necessarily detract from the qualitative evolution of their submarine fleets. Generally, besides fleet sizes, the technical capabilities of submarines entering service with Indo-Pacific navies have improved. Submarines in most fleets have become progressively bigger over the decades in terms of length and displacement (see Figure 2 for a sample of navies)

Size confers numerous straightforward operational and tactical advantages. Most intuitive of all, a larger submarine typically has a larger payload for combat systems, weapons, and other mission equipment. The other important benefit is more space for enhanced crew habitability — a key concern in recent times as regional navies struggle to recruit submariners, given that a submarine usually has cramped spaces on board and offers nothing more than a spartan lifestyle.

Combined with better payloads and crew habitability, new submarines entering service with Asian navies also increasingly sport new propulsion systems. For conventional fleets, Stirling or fuel cell–type air-independent propulsion (AIP) — dubbed the “poor man’s nuclear submarine propulsion” — confers conventional submarines greater underwater endurance with reduced need for snorkelling (meaning, expelling exhausts while taking in air, usually to recharge batteries). Some submarines, such as the Japanese Soryu/Taigei and Indonesia’s planned Scorpene Evolved sport lithium batteries which, unlike typical AIP, confers the additional feature of higher underwater burst speeds. At least six Asian submarine-operating navies are already operating, or in the midst of acquiring, these new propulsion technologies.

A submarine’s real combat power lies not just in its size, but also the type of payloads on board. Traditionally, submarines carry torpedoes and mines. Unlike boats built before 1945, modern equivalents no longer carry deck guns. But today’s submarines are increasingly capable of a more diverse payload. For example, underwater-to-surface guided weapons, such as anti-ship and land attack cruise missiles, offer long-range, standoff striking power. The redundancies conferred by larger payloads on board the modern submarine also allow future incorporation of new technologies, such as unmanned systems. Topping off the larger and more diverse payloads, contemporary submarines entering service with Asian navies are also increasingly “quieter”, with not only better acoustic emission characteristics for the propulsion but also hydrodynamic designs and use of anechoic tiles installed on the hull to absorb detection sonar waves.

Parting Thoughts

The Asian undersea realm has been a long-standing area of interest for many regional navies as an outcome of threat perception and the bid to create “balanced fleets” that serve as insurance against extant geopolitical uncertainties. While the expanding numbers of submarines entering service matter, it is important not to overlook the evolving qualitative characteristics of new boats coming online at present and into the future. These attributes could potentially give rise to misperceptions about strategic intent and pose possible risks, especially in the contentious Asian littorals revolving around geopolitical flashpoints such as the South China Sea. While the current submarine proliferation can be more suitably characterised as “underwater arms competition” and not a relentless “underwater arms race” for now, recent geopolitical upheavals in the region still provide grounds for concern.

Somewhat more worrisome has been the potential risk of accidents at sea. Recent collisions involving the American submarine Connecticut in the South China Sea in late 2021 and Japanese submarine Oyashio in early 2022 suggest that such risks can no longer be taken for granted. Most navies in the region have mainly focused on mitigatory measures, for example acquiring new submarine emergency response capabilities. But such programmes are accorded much less priority than plans to acquire submarines and other big-ticket combat assets. Some navies have struck bilateral submarine rescue pacts either as a stop-gap before acquisition of, or to complement, national capabilities. While regional geopolitics have become more contentious, resulting in a deep strategic trust deficit among governments, it is necessary to seriously consider preventive measures, such as prevention of mutual interference and water-space management initiatives.

Collin Koh is Senior Fellow at the Institute of Defence and Strategic Studies, S. Rajaratnam School of International Studies (RSIS). He primarily researches maritime security and naval affairs in the Indo-Pacific region, focusing on Southeast Asia.